All Categories

Featured

Table of Contents

Rate of interest will certainly be paid from the date of fatality to day of repayment. If fatality results from all-natural causes, fatality earnings will be the return of costs, and rate of interest on the costs paid will be at a yearly effective price specified in the plan agreement. Disclosures This plan does not ensure that its earnings will certainly be sufficient to spend for any specific solution or goods at the time of demand or that solutions or product will be offered by any type of specific carrier.

A complete declaration of insurance coverage is found just in the policy. Dividends are a return of premium and are based on the real death, cost, and investment experience of the Company.

Long-term life insurance policy establishes cash worth that can be borrowed. Plan financings build up interest and unsettled policy finances and rate of interest will certainly minimize the fatality advantage and cash money worth of the plan. The amount of money value available will usually rely on the sort of irreversible policy purchased, the amount of insurance coverage acquired, the length of time the policy has actually been in force and any type of superior policy fundings.

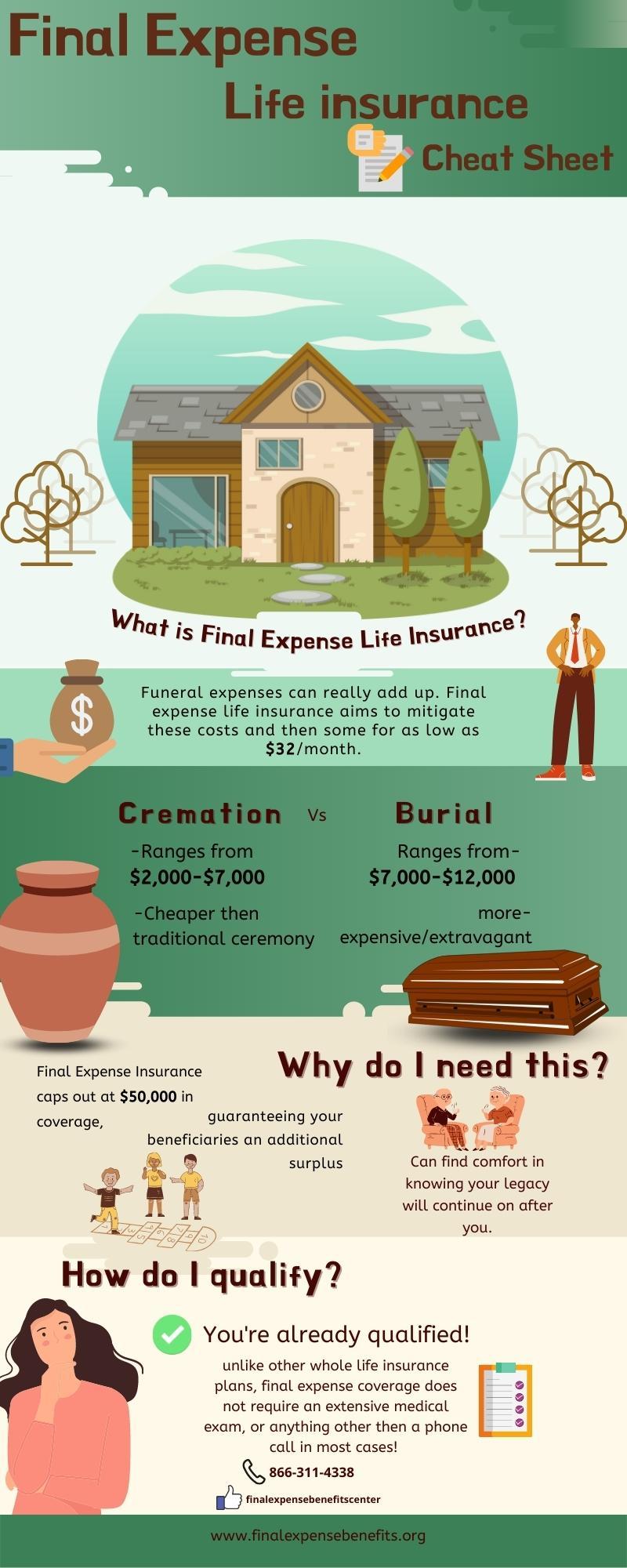

Affiliate web links for the items on this web page are from partners that compensate us (see our advertiser disclosure with our list of partners for even more details). Our opinions are our very own. See exactly how we rank life insurance coverage products to write unbiased item testimonials. Funeral insurance is a life insurance coverage policy that covers end-of-life costs.

Interment insurance needs no medical test, making it available to those with medical conditions. The loss of a loved one is emotional and distressing. Making funeral preparations and locating a way to pay for them while regreting includes an additional layer of tension. This is where having funeral insurance policy, also called final expenditure insurance coverage, is available in useful.

Simplified problem life insurance policy calls for a health and wellness analysis. If your health and wellness standing disqualifies you from typical life insurance coverage, interment insurance policy may be an alternative.

Life Insurance To Pay For Funeral Expenses

Compare inexpensive life insurance alternatives with Policygenius. Besides term and irreversible life insurance policy, interment insurance is available in several kinds. Take an appearance at your coverage choices for funeral expenditures. Guaranteed-issue life insurance policy has no wellness requirements and supplies fast approval for coverage, which can be valuable if you have extreme, incurable, or multiple health conditions.

Simplified problem life insurance policy doesn't call for a clinical test, yet it does need a health and wellness set of questions. So, this policy is best for those with moderate to modest wellness conditions, like hypertension, diabetic issues, or asthma. If you do not desire a medical examination but can receive a streamlined issue plan, it is normally a far better offer than a guaranteed problem policy since you can obtain more protection for a less costly costs.

Pre-need insurance is high-risk since the recipient is the funeral home and insurance coverage specifies to the picked funeral chapel. Must the funeral home go out of company or you vacate state, you might not have protection, which defeats the function of pre-planning. Furthermore, according to the AARP, the Funeral Service Consumers Partnership (FCA) discourages getting pre-need.

Those are essentially funeral insurance policy policies. For guaranteed life insurance, costs estimations depend on your age, sex, where you live, and protection amount.

Old Age Funeral Cover

Burial insurance policy supplies a simplified application for end-of-life coverage. The majority of insurance coverage business require you to speak to an insurance policy agent to use for a policy and obtain a quote.

The goal of living insurance coverage is to reduce the concern on your loved ones after your loss. If you have an additional funeral service plan, your enjoyed ones can make use of the funeral policy to manage final costs and get an instant dispensation from your life insurance to take care of the mortgage and education and learning expenses.

Individuals who are middle-aged or older with clinical conditions may take into consideration burial insurance policy, as they might not get standard policies with stricter approval requirements. Additionally, funeral insurance policy can be practical to those without substantial cost savings or typical life insurance policy coverage. national burial insurance company. Funeral insurance differs from other sorts of insurance coverage in that it offers a reduced survivor benefit, normally just sufficient to cover costs for a funeral service and other linked costs

ExperienceAlani is a former insurance coverage fellow on the Personal Finance Insider group. She's assessed life insurance policy and family pet insurance companies and has written countless explainers on travel insurance policy, credit rating, financial debt, and home insurance coverage.

Funeral Cover Under 50

The even more insurance coverage you obtain, the higher your costs will certainly be. Final expense life insurance coverage has a number of advantages. Specifically, every person who applies can get authorized, which is not the situation with other kinds of life insurance policy. Last cost insurance coverage is often suggested for seniors who might not qualify for traditional life insurance policy because of their age.

In addition, final cost insurance coverage is advantageous for people that intend to spend for their own funeral service. Interment and cremation solutions can be pricey, so final expense insurance offers assurance knowing that your loved ones won't have to use their financial savings to pay for your end-of-life plans. Nevertheless, last expense protection is not the best product for everyone.

Obtaining entire life insurance coverage with Ethos is quick and easy. Protection is offered for elders between the ages of 66-85, and there's no medical test required.

Based upon your responses, you'll see your approximated price and the amount of insurance coverage you get (in between $1,000-$ 30,000). You can purchase a plan online, and your insurance coverage begins instantly after paying the first costs. Your price never ever alters, and you are covered for your whole life time, if you continue making the regular monthly settlements.

How Does Funeral Insurance Work

Last expense insurance uses benefits but requires careful consideration to identify if it's best for you. Life insurance policy for final expenditures is a kind of irreversible life insurance designed to cover costs that arise at the end of life.

According to the National Funeral Service Directors Association, the average price of a funeral service with burial and a viewing is $7,848.1 Your liked ones might not have accessibility to that much cash after your fatality, which can include in the anxiety they experience. In addition, they might encounter other costs connected to your death.

Last cost insurance coverage is in some cases called funeral insurance, but the money can pay for basically anything your enjoyed ones need. Beneficiaries can make use of the fatality benefit for anything they require, permitting them to attend to the most important financial concerns.

: Employ specialists to assist with managing the estate and navigating the probate process.: Shut out make up any end-of-life treatment or care.: Repay any kind of various other financial obligations, consisting of automobile fundings and credit history cards.: Recipients have full discretion to utilize the funds for anything they need. The cash can even be used to develop a legacy for education and learning expenditures or contributed to charity.

Table of Contents

Latest Posts

Burial Insurance Arkansas

Final Expense Meaning

Open Care Final Expense Coverage

More

Latest Posts

Burial Insurance Arkansas

Final Expense Meaning

Open Care Final Expense Coverage